Filing Tax

Please fill Self-Assessment Tax Application Form A – 001 and click “Submit Form” to file tax.

Steps for completing your Self-Assessment tax payment

Requirements

An email is needed to file the tax.

Before paying tax

You will need to complete the Self Assessment tax application Form A – 001 to start the tax return process. After submitting Form A – 001, you will receive an email from the Internal Revenue Department of the National Unity Government with

(1) the Tax Application Number,

(2) the link to the Self Assessment Payment Form B – 001.

(3) the NUG’s bank details and

(4) NUGPay Wallet Name or SDB Account Username, and QR Code of the Internal Revenue Department

This email will be sent from the [email protected].

Please take note the Tax Application Number that is stated in the email carefully and use that number as a reference when making tax payment to the NUG’s bank account, NUGPay Wallet or SDB Account of the Internal Revenue Department.

To make tax payment using International bank transfer

- Since the NUG’s bank account is a US dollar account, tax payers will need to make the payment amount in US dollar.

- You will need to make your own arrangement to make payment to NUG’s bank account using an International Bank to Bank Transfer method.

- Should you make payment to the NUG’s US dollar bank account, your tax payment will be converted to USD and you will receive the Unique Identification Number accordingly.

- You will need to enter the Tax Application Number, which is stated in the your email, at the Reference or Purpose of transfer or Note or Intomation or Message to beneficiary when making the tax payment to the NUG’s bank account.

- If you use the Wise Application to make tax payment, please state the Tax Application No. in Bank Reference and enter the email address: [email protected].

Points to note while making tax payment using International bank transfer

- The bank charges and transaction fees shall be paid by the tax payer. The tax payment is the net amount received in the NUG’s account.

- International bank transfer payments may be regulated with a daily payment limit.

- Please enter the Self Assessment Tax Application Number in the Reference field of the bank transfer form. The field may also be described on the form as “Purpose to transfer”, “Information”, “Note” or “Message to beneficiary”.

- It usually takes 1-3 days for the transfer to be completed

- The tax payment process, i.e. the bank transfer, processing the payment and the IRD’s acknowledgement of the payment received may take between 3 to 7 days.

- From time to time, emails from the IRD may be incorrectly identified as spam or junk emails by your email filter so please check your spam/junk folder of your email before contacting the IRD.

To make tax payment using NUGPay

- Wallet Name: ird.nug*nugpay.app

- QR Code:

- You shall ensure the Wallet Name ird.nug*nugpay.app is correct.

- Please check that tax payment amount is correct.

- When making tax payment, please input the Tax Application Number in the Note without fail.

- In Form B, you will need to attach the screenshot of Money Sent Amount, NUGPay Wallet Name & 18-digit Transaction ID from the Recent Activities of the NUGPay Wallet App.

Points to note while making payment using NUGPay

- When making tax payment, please input the Tax Application Number in the Note without fail.

- In Form B, you will need to attach the screenshot of Money Sent Amount, NUGPay Wallet Name & 18-digit Transaction ID from the Recent Activities of the NUGPay Wallet App.

- It usually takes 1-3 days for the transfer to be completed.

- Please look out for the emails from IRD ([email protected] and [email protected]) in your Junk/ Spam folder of your email for before contacting the IRD.

To make tax payment using Spring Development Bank (SDB)

- Account Username : @irdmopfi

- UID : a55db188-5ef6-4b33-b21e-bdc4875c2653

- QR Code:

- You shall ensure the Account Name @irdmopfi is correct.

- Please check that tax payment amount is correct.

- When making tax payment, please input the Tax Application Number in the Note without fail.

- In Form B, you will need to attach the screenshot of Sent Amount, SDB Account Username Name & 24-digit Transaction ID from the History of the SDB Web App.

Points to note while making payment using SDB

- When making tax payment, please input the Tax Application Number in the Note without fail.

- In Form B, you will need to attach the screenshot of Sent Amount, SDB Account Username Name & 24-digit Transaction ID from the History of the SDB Web App.

- It usually takes 1-3 days for the transfer to be verified.

- Please look out for the emails from IRD ([email protected] and [email protected]) in your Junk/ Spam folder of your email for before contacting the IRD.

After the tax payment

- You must complete the Self Assess Tax Payment Details Form – B -001

- Upload and submit the evidence of bank transfer or other relevant document as attachment.

- If you cannot complete the taxpayer details due to security concerns during the revolution, you can complete only a contact email address, the evidence of bank transfer, and memorable details.

- After successful completion of the international bank transfer, the IRD will send you a letter of appreciation and a Unique Identification Number.

- Since the Unique Identification Number issued is the evidence of your tax payment, please keep it as a piece of confidential information.

- If you use the Wise Application to make tax payment, please input the Tax Application No. in Bank Reference and enter the email address: [email protected].

Group Tax Filing

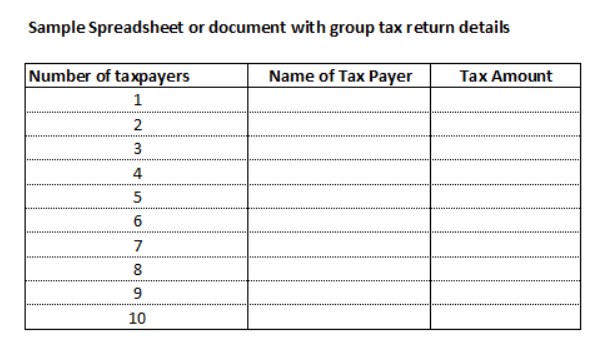

Up to 10 individual taxpayers may choose to file a tax return collectively in a single transaction.

Requirements for group tax filing

• In Form B-001, choose “Yes” in response to the question, “Are you filing tax on behalf of a group of taxpayers?”.

• After tax payment has been made to the designated NUG account, it is essential to complete Form B-001.

• It is necessary for Form B-001 to be completed for each individual taxpayer within the group. For example, in a group of five individuals, Form B-001 should be completed five times, using the same tax application number. In the relevant section, specify the taxpayer number as 1, 2, 3, 4 or 5 as applicable.

For example, in a group of five individuals, Form B-001 should be completed five times, using the same tax application number. In the relevant section, specify the taxpayer number as 1, 2, 3, 4 or 5 as applicable.

• The Internal Revenue Department will then issue a Unique Identification Number for each individual taxpayer within the group.

• Evidence of payment and group tax return details document or spreadsheet must be uploaded for each B-001.

- When the tax amount in the group tax return details uploaded is different from the amount received at the NUG Bank account or SDB account, a Unique Identification Number will be issued only for the actual amount received.

The IRD of the National Unity Government of Myanmar would like to thank all the taxpayers who fulfilled their duties during the revolution.

The Revolution Shall Prevail.